Key Themes

Key themes over the last couple of years for clients are that while cost pressures are real, most have experienced reasonable returns and balance sheets have never looked better.

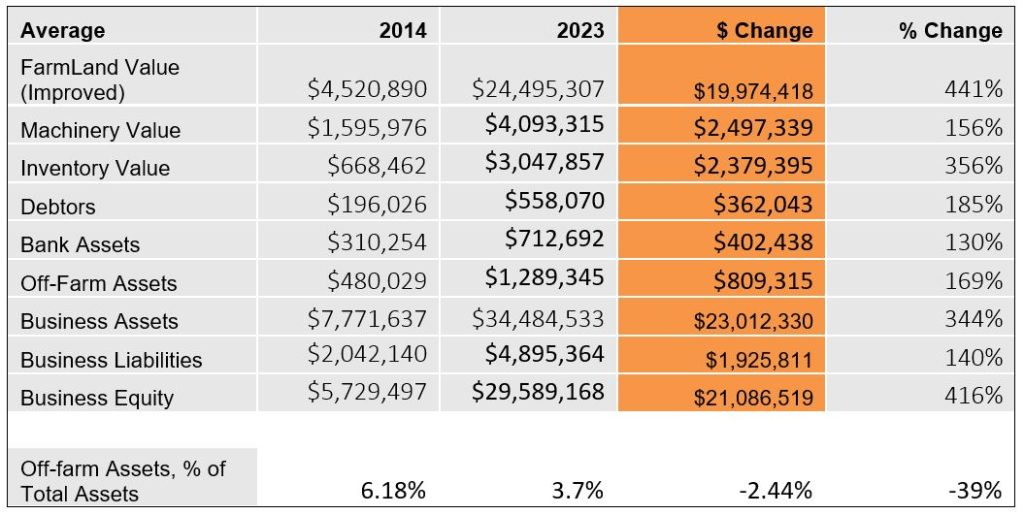

But the growth in farm asset values has altered clients’ total asset mixes.

While off-farm assets have grown in total dollar terms, as a proportion of total assets they have shrunk. Also, as farmland values have often outpaced earnings growth, returns on farm asset values have contracted.

So many clients are looking at what opportunities are available off-farm, and if they can utilise on-farm equity to build off-farm wealth.

Size of the change

Off-farm assets can provide a diversified income stream for farm business owners, steady income in retirement and useful non-agricultural assets in transition planning.

Looking at a sample of Wimmera and Mallee cropping clients over a 10-year period to 2023, we can start to see the size of the change. Off-farm assets as a percentage of total assets reduced 39% over the period.

Impact of change and planning for transition

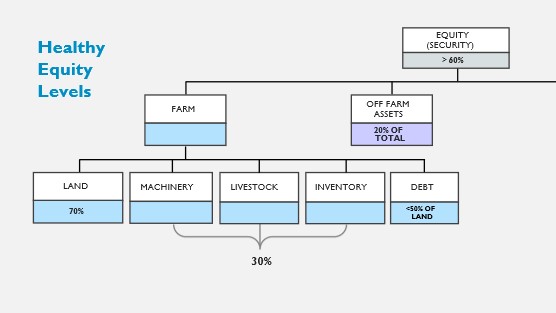

Farming families are finding that to attain the same financial split of assets as ten years ago, it often results in the farm having to take on more debt or sell assets.

By planning early and leveraging these stronger levels of equity now, farmers may be able to reduce the pressure on the farm business when it comes to transition later.

If you want to find out more get in touch with ORM, or come see us at the field days at Speed.